Managing finances in 2025 has become so much easier than before. With the evolving technologies and emerging new apps, you can easily handle any financial crisis within seconds. Through these digital payment platforms, you can do any monetary transaction.

Moreover, you can borrow money from the apps as short-term loans for your financial needs. For this, you don’t need to go through the tedious and time-consuming loan-taking process in the banks.

One such payment platform is the Cash App. In this app, you can efficiently manage your financial needs with short-term cash loans. You just have to simply open the app, register your account, and apply for the cash loans.

Additionally, the best part about Cash App borrowings is that you can also increase the borrowing limit. So, you can borrow more than the $20 minimum limit on the app.

Wanna know how to apply and increase your Cash App borrow limit in 2025? Keep reading to know more!

Cash App: Features of the Payment Platform

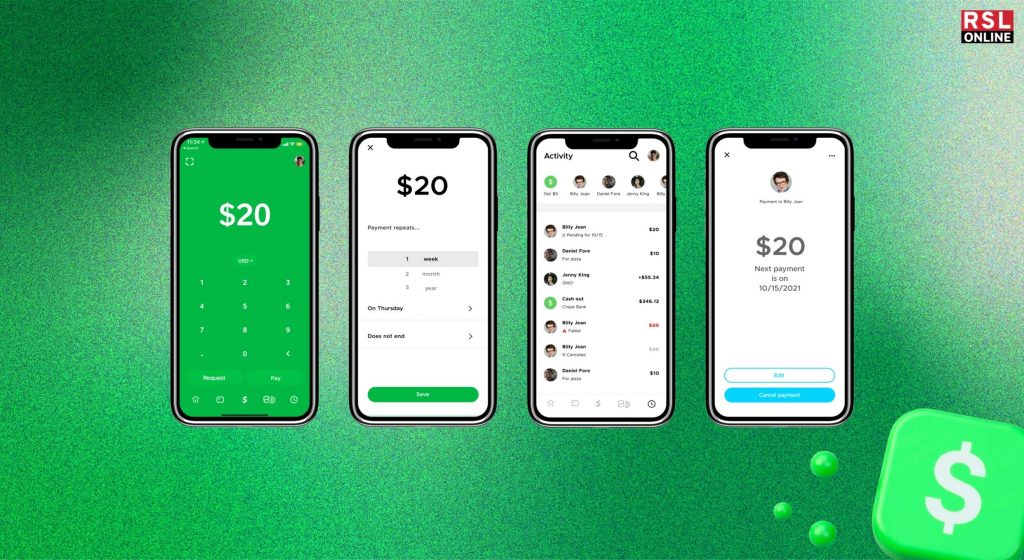

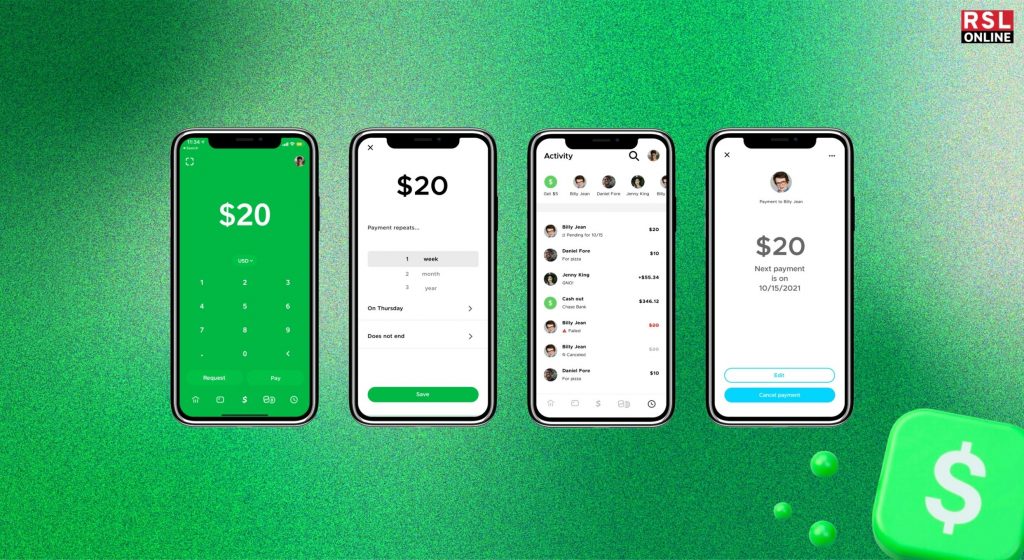

Cash App is a new and trending payment platform that is gaining popularity among US and UK customers. It is a financial management app that lets you to send, receive, invest, and also borrow money.

You can use the Cash App as your digital wallet to keep money for various kinds of digital monetary transactions. Also, you can have a Cash App debit card to use for payments with cards.

The best part about the Cash App is its easy interface, quick processing, and convenience in everyday usage. However, the app has many drawbacks that limit its performance in the financial field.

The app has a very limited protection against fraud and scams. So, there is a high chance that you might face fraudulent payment risks with phishing scams and fake security alerts.

However, if you are cautious and take proper preventive measures, you can safely browse through the features of the Cash App. And you can also borrow short-term money for your immediate financial needs.

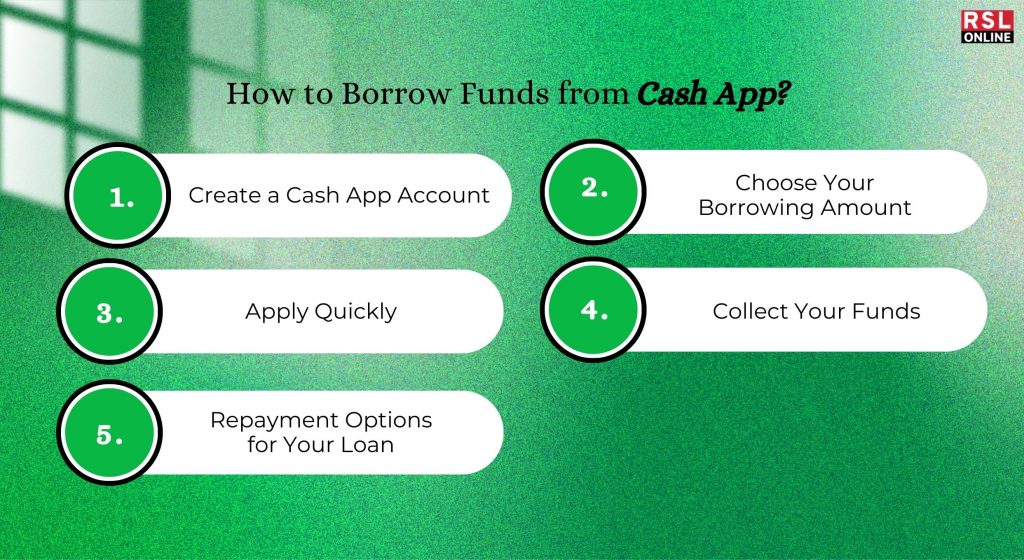

How to Borrow Funds from Cash App?

Cash App is mainly popularized for its cash borrowing feature. But not everyone can access this borrowing feature in their account.

So, how to borrow funds from Cash App? Here’s a step-by-step guide on how you can borrow money from your Cash App account.

Step 1: Create a Cash App Account

Before starting off with borrowing money from the Cash App, you need to register yourself on the app. Create your Cash App account on the app using your bank details and registered email ID. Then, you can transfer some money from your bank account to this digital wallet.

Step 2: Choose Your Borrowing Amount

Once your Cash App account is created, you need to check whether you are eligible for taking a loan. If your credit history and account activity are not proper, you might not be able to take loans on Cash App. For that, you can try other digital payment platforms.

However, if you are eligible to apply for Cash App loans, you need to choose your borrowing from the range of $20 to $200. So, you can pick the amount you want for your immediate needs.

Step 3: Apply Quickly

After you have decided on the amount you need to borrow, you just need to fill out the Request a Loan form on the app. Or you can also fill out the online application form for Viva. Either way, you don’t need to go through any tedious paperwork to take a small loan.

Step 4: Collect Your Funds

After a few minutes, you will receive the notification that your request for your short-term loan is approved. Then, the money will be transferred to your Cash App account. So, when you check your balance on the app, the borrowed money will be reflected on your balance.

Step 5: Repayment Options for Your Loan

There is a specific period of time within which you need to repay your borrowed money to the Cash App. Generally, for small borrowings, the time period is four weeks. So, make sure that you repay the loan within the four weeks to keep your credit score up.

What is the Highest Borrow Limit on Cash App?

Cash App has a specified range for its borrowings and short-term loans. This range usually starts from $20 and increases up to $200 for every individual. However, you can easily increase this limit for your account.

Moreover, the higher the borrowing limit for your Cash App account, the more money you can take as a loan. Also, the highest limit for Cash App borrowing is somewhere around $1000. So, you can increase your Cash App borrow limit to get the maximum funds for your financial needs.

How to Increase Cash App Borrow Limit?

Increasing your Cash App borrow limit can be a little bit tricky, as there are no specific rules and steps. However, many users have mentioned how they have increased their Cash App borrow limit within a few months.

Based on their experience with the Cash App borrowings, here are some tips that you can try to increase your Cash App borrow limit.

- First and foremost, you need to maintain a good credit score in the app. This will increase your chances of getting access to the increasing borrow limit option.

- You should also regularly use your Cash App account to show that you are actively using your money. Moreover, this also shows whether your account is active or inactive.

- If you have verified your Cash App account with your SSN (Social Security Number), then you have a higher chance of increasing your borrow limit. The app verifies that you are not a robot or digital scammer through your SSN and your banking details.

- Moreover, you can also increase your borrow limit on the app with an improved and quick repayment period. If you can repay the loan within 48 hours, then the app instantly increases your borrow limit based on your quick repayment.

These are some of the ways you can increase the Cash App borrow limit from $200 up to $1000. Also, you should use the app properly and repay loans quickly to ensure that your credit score is high at all times.

Pros and Cons of Cash App

Here is a list of all the pros and cons of using the Cash App to borrow money for short-term financial requirements.

Pros

- Cash App allows you to borrow money instantly without any tedious banking processes and paperwork.

- It is the best solution for short-term financial emergencies. You can use Cash App borrowings to mitigate your immediate financial needs.

- You can use the Cash App conveniently for your monetary transactions, as it is completely integrated within the app features.

Cons

- There is a limit for borrowing money on the Cash App. So, you will not be able to get a huge amount of money for your financial needs.

- The app has a strict repayment policy for short-term loans. In case you fail to repay the borrowed money within four weeks, you will be charged with a 5% additional fee for late repayment.

- Not everyone can borrow money on the Cash App. There is a specific eligibility criterion that the app refers to before approving the loan requests.

- Cash App is well-known for being vulnerable to scams and fraudulent payments. So, there is a potential for high financial risk with the usage of the app.

Avoid Cash App Scams Efficiently

As it is known to all, there is a high risk of facing scams and fraudulent activities while using the Cash App. So, how can you protect yourself from getting scammed on the app?

Here are some tips and tricks that you can follow to avoid Cash App scams efficiently.

- You should not disclose your personal and sensitive information to any customer care representative from Cash App. Most scammers impersonate as customer service representatives to collect your private details.

- While using the Cash App, you might get phishing emails and messages claiming you have a pending payment from scammers. You should never respond to these emails or click on the suspicious links attached to the messages.

- You should never trust any third party or social media account for investing in schemes that promise high returns for minimal investment. These scammers will take your money and disappear without giving you any returns.

Our Advice

Now that you know how to borrow money and increase your borrowing limit in Cash App, you need to use the app cautiously to avail all its benefits.

You should refrain from taking loans from suspicious people and accounts. And timely repay your short-term loans on the Cash App for a better credit score. Also, when you take proper measures and follow the tips, you can conveniently use the Cash App for all your monetary transactions.

Read Also: