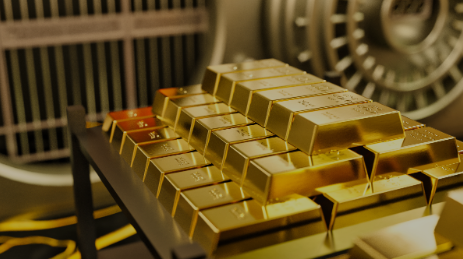

The appeal of gold as an investment is timeless. With market fluctuations and the uncertainty of traditional investments, many are turning towards precious metals like gold for their Individual Retirement Accounts (IRAs).

Lately, the allure of Home Storage Gold IRAs has surged, promising the comfort of physical possession of gold at home. However, before you jump on the bandwagon, it’s crucial to understand the nuances of such an investment.

This comprehensive guide will delve into the what, why, and how of Home Storage Gold IRAs, helping you make an informed decision.

Understanding Home Storage Gold IRAs

Home Storage Gold IRAs have been the topic of many investment discussions due to their promise of security and control. These accounts allow investors to hold physical gold or other approved precious metals like silver, platinum, and palladium at home or in a home safe.

Unlike traditional IRAs, where your investment is in paper assets like stocks, bonds, or mutual funds, a Home Storage Gold IRA offers an investment in actual, physical gold.

However, the independence that comes with such an IRA also brings a slew of responsibilities and challenges. Let’s delve deeper to understand what it entails.

The Appeal Of Home Storage Gold IRAs

The allure of a Home Storage Gold IRA lies in its tangible nature. Being able to physically hold your investment gives a sense of comfort and control. Furthermore, gold has been a symbol of wealth and a reliable store of value for centuries. It’s a finite resource, unaffected by the volatility that plagues the stock market.

In the face of economic uncertainty, gold acts as a hedge against inflation, maintaining its purchasing power over time. The tax benefits of a gold IRA, coupled with the luxury of home storage, make it an attractive proposition for many investors.

However, this glittering allure does not come without its share of challenges and risks.

Legal Implications And IRS Guidelines

The Internal Revenue Service (IRS) has stringent rules about how IRA-held precious metals should be stored. According to Section 408(m) of the IRS Code, these metals must be in the “physical possession of a trustee.” This trustee must be an IRS-approved bank or a non-bank trustee meeting specific requirements.

The IRS’s stance on Home Storage Gold IRAs is clear: the physical possession of IRA-acquired precious metals at home is strictly prohibited. Any violation of these rules can have severe tax implications and potential legal consequences.

Potential Risks And Penalties

Venturing into Home Storage Gold IRAs exposes you to several risks and potential penalties. To start with, the IRS frowns upon such IRAs and may impose hefty fines if they find any non-compliance during an audit.

If you’re found to possess IRA-purchased gold at home, you could face distribution penalties. This move could amount to a distribution, resulting in a 10% penalty if you’re under 59.5 years of age. Moreover, the tax-deferred status of your investments evaporates, and you end up owing income tax on the distribution.

The Confusion Surrounding Home Storage Gold IRAs

The concept of Home Storage Gold IRAs has generated considerable confusion, primarily due to deceptive advertising.

While you can technically set up an LLC (Limited Liability Company) and manage your IRA purchases yourself, storing the gold at your residence is strictly prohibited. It must be in a secure, depository location under the LLC’s name. Failure to comply with these rules can lead to harsh financial penalties.

The Realities Of A Gold IRA

Contrary to the illusion of ease projected by Home Storage Gold IRAs, the reality involves a close alliance with IRS-approved custodians, usually a bank or another financial institution. They handle disbursements, maintain records for the account, and perform the required IRS reporting.

Once the account is open, you can fund it via a rollover or transfer from an existing retirement account or contribute via check or wire payment. The maximum annual contribution is $7,000 (if you’re at least 50 years of age).

After funding your account, you direct your IRA custodian about which gold bullion to buy and how much. Make sure to store this gold in an approved depository location.

How To Open A Gold IRA The Right Way

Given the risks and legal implications of Home Storage Gold IRAs, it’s critical to tread carefully when opening a gold IRA account. Always compare multiple options, read reviews, and ensure the company’s reputation and experience before proceeding.

A reliable gold IRA provider can simplify the process of opening a legitimate gold IRA account, ensuring you reap the benefits of this type of investment without risking IRS penalties or jeopardizing your retirement savings.

Alternatives To A Home Storage Gold IRA

If you’re attracted to the idea of physically possessing gold but wary of the risks of a Home Storage Gold IRA, there are alternatives. A Self-Directed IRA managed by an authorized custodian can offer the same control over your investment without the associated liability and regulatory risk.

Such an IRA allows you to invest in a variety of asset classes, including precious metals, while ensuring compliance with IRS rules. The custodian handles all administrative duties, and your precious metals are stored securely at an IRS-approved depository.

The Process Of Setting Up A Gold IRA

Setting up a Gold IRA involves following some key steps. First, you need to choose a reputable gold IRA investment company. Once chosen, the provider will help you open a gold IRA account. You can fund your account by rolling over funds from an existing retirement account or making contributions directly.

Next, you can use the funds to buy gold or other precious metals. The gold IRA provider will handle the transportation of your gold to the depository, making the process hassle-free for you.

Concluding Thoughts

Home Storage Gold IRAs may seem like an appealing investment option, offering control and physical possession of gold. However, the complexities, legal restrictions, and potential penalties make it a risky venture.

As an investor, you’re better off considering safer alternatives like a Self-Directed IRA managed by a qualified custodian. This approach offers the benefits of physical gold investment while ensuring compliance with IRS rules and regulations.

Investing in gold can be a solid strategy to protect your retirement savings from market volatility and inflation. By choosing the right investment vehicle, you can enjoy the benefits of gold while securing your financial future.

Read Also: