A business plan for a small business is its roadmap to what the small business owner hopes will be a successful journey.

As with everything else in life, the more effort and concern you invest in your small business and small business plan, the more you get back from it. The business plans for small businesses are the primary footwork for stepping a big foot in the industry.

When drafting a small business plan, consult business accounting services to have them assess your plan. Keep reading to learn more about small business financial plans and why they are critical for success.

What Is A Financial Plan?

A financial plan is a set of financial statements, calculations, business strategies, and projections based on financial data. You know why business plans for small businesses are so important.

Let’s see how to create a financial business plan for your business.

What Should Be Included In A Financial Plan?

The answer depends on the industry you are in, how you operate your business, your business and financial goals, etc. Use the financial statements that make the most sense. The ones below are commonly found in most financial business plans for small businesses.

1. Income Statement

Also known as a Profit & Loss Statement or Consolidated P&L, an Income Statement shows the amounts and sources of all of your small business’s revenues and expenses.

In an income statement, you subtract your expenses from your revenues to calculate your gross margin. The business plans for small businesses always include the income statement.

2. Cash Flow Statement

Whether your business uses the cash or accrual method of accounting, a cash flow statement simply looks at all the transactions in a period of time (usually a month) and calculates whether you received more money than you paid out or vice versa.

The cash flow statements give you an idea of which purposes you need to spend for. And how much money you can save in your profit bag.

3. Operating Income

To calculate your operating income (aka gross income), you subtract your operating expenses from your gross margin.

The resulting number of business plans for small businesses is also referred to as your earnings before interest, taxes, and amortization (EBITDA.)

4. Net Income

To calculate your net income, simply subtract the interest, tax amount, depreciation amount, and amortization from your actual operating income.

Your net income is your profit, and if your small business isn’t currently profitable, by the time you’ve reached this calculation, you should know how long it will take before you are. The business plans for small businesses always include the net income.

5. Balance Sheet

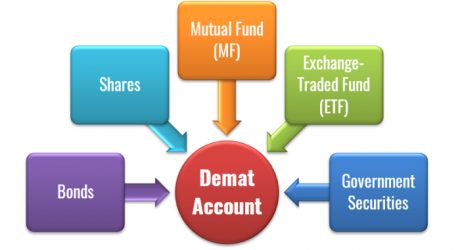

A balance sheet shows you how your business is performing at any particular moment in time. It lists out all of the business assets in your business plans for small businesses. These assets come with liability and equity.

For example, the shares, net and earnings, stock proceeds, and owner’s equity everything comes under this balance sheet. This sheet ensures that the assets and equal to the liabilities and the equity.

6. Sales & Revenue Projections

With one more year of sales and revenue on the books, you now have something to compare against in the future. You also now have access to actual numbers, which you can use moving forward and looking back to compare how accurate the business plans for small businesses model is at predicting future growth and what tweaks, if any, may be helpful.

Now it’s the time for your hard-earning data, sales, and other revenue projections. These projections give an accurate revenue idea. The inventory planning and cash flowing are going to be far more accurate when you are turning on the cash flow of the project. All types of functions are possible when you are running the sales and revenue projections.

7. Monitor And Reassess

It’s absolutely vital to revisit business plans for small businesses, and it’s a strategy that evaluates its performance vs its goals. Without constant reassessment, your business will not know where it stands or if its plans even work.

As with all plans and strategies, assessing the performance of the strategies and decisions made based on the financial statements in the financial plan is critical for your small business’s success. These assessments should be scheduled at regular intervals as part of your operations.

Create A Winning Business Plan!! Reach Out Your Goal

Every business plan for small businesses is going to be far more accurate. As this is more like a road map where you have to travel to reach your business goals and profit margins. These are the following steps and initiations which you must follow to achieve your business target. So first start with analyzing your target, then start to work through your business planning and each of your goals.

Additionals: